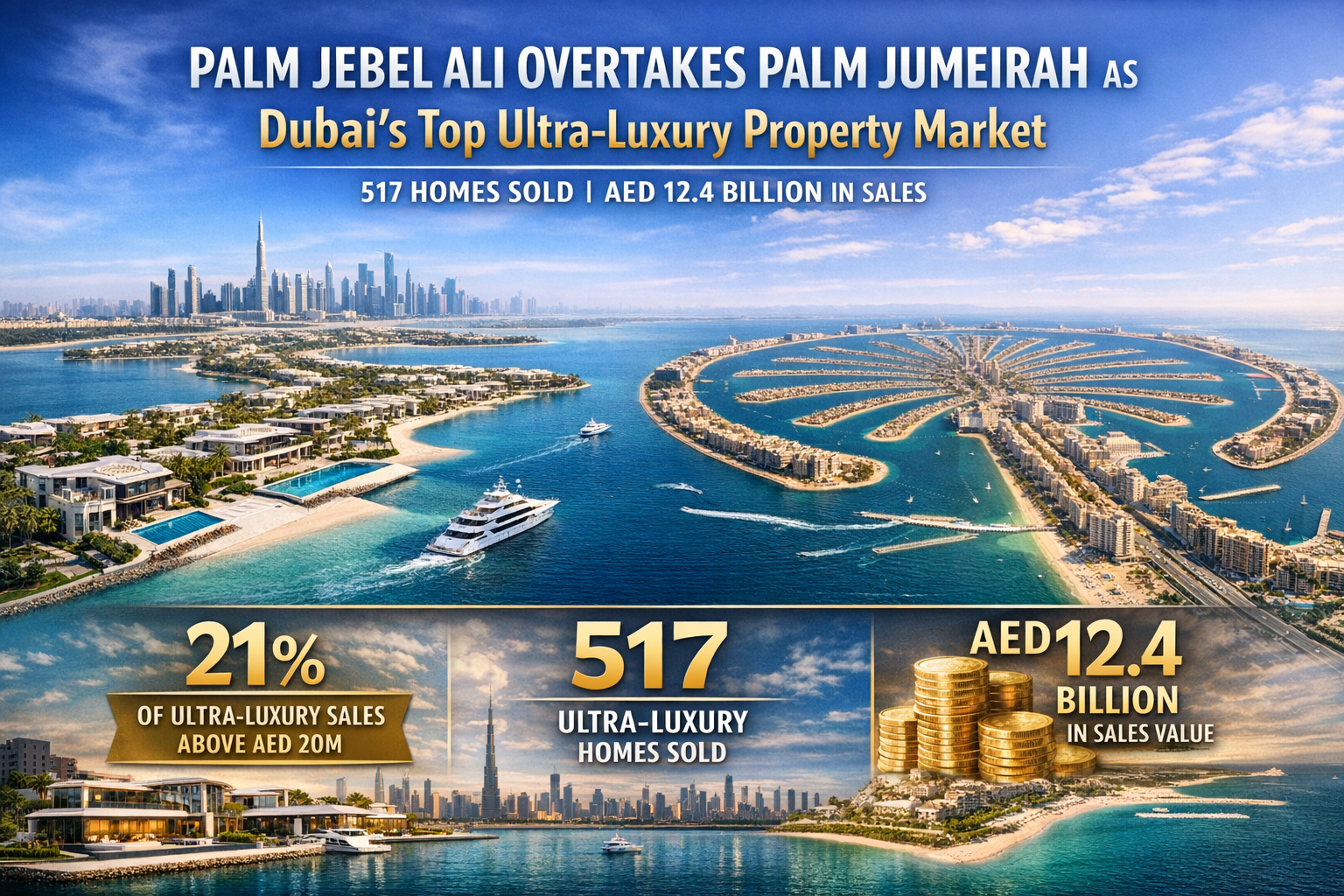

Dubai’s ultra-prime real estate landscape has entered a new phase of dominance, with Palm Jebel Ali surpassing Palm Jumeirah as the emirate’s leading ultra-luxury property market. Recent market data confirms that Palm Jebel Ali accounted for 21% of all ultra-luxury transactions above AED 20 million, with 517 homes sold and a staggering AED 12.4 billion in total sales value—the highest recorded by any residential location in Dubai.

This landmark performance signals a structural shift in Dubai’s high-net-worth property investment ecosystem, placing Palm Jebel Ali at the epicenter of global luxury capital flows.

Palm Jebel Ali: The New Benchmark for Ultra-Luxury Transactions

Palm Jebel Ali’s emergence as Dubai’s premier ultra-luxury market reflects both transactional volume and capital concentration. With 517 ultra-luxury homes sold, the development not only led in total transaction value but also demonstrated superior depth in high-ticket inventory absorption.

The AED 12.4 billion in cumulative sales value positions Palm Jebel Ali as the strongest performing micro-market in Dubai’s luxury residential segment. This performance eclipses Palm Jumeirah, long considered the emirate’s flagship address for ultra-high-net-worth individuals (UHNWIs).

Key indicators reinforcing Palm Jebel Ali’s leadership:

-

21% share of ultra-luxury deals above AED 20 million

-

Highest aggregate sales value among Dubai communities

-

Strong off-plan and branded residence demand

-

Accelerated capital appreciation trajectory

The concentration of ultra-prime buyers in this emerging master development confirms a decisive investor pivot toward scale, exclusivity, and long-term capital growth.

Ultra-Luxury Property Market in Dubai: A Structural Evolution

Dubai’s ultra-luxury real estate segment—defined by properties transacting above AED 20 million—has witnessed unprecedented momentum over the past 24 months. International wealth migration, residency incentives, tax efficiency, and currency arbitrage have amplified inbound investment.

Within this framework, Palm Jebel Ali has captured a disproportionate share of ultra-prime liquidity.

While Palm Jumeirah remains globally iconic, the data illustrates a strategic shift:

| Metric | Palm Jebel Ali | Palm Jumeirah |

|---|---|---|

| Ultra-Luxury Share | 21% | Lower comparative share |

| Homes Sold | 517 | Fewer in same bracket |

| Sales Value | AED 12.4B | Below Palm Jebel Ali |

The shift is quantitative, not anecdotal. Palm Jebel Ali now commands the most significant volume of transactions within Dubai’s highest pricing tier.

Why Palm Jebel Ali Is Capturing Ultra-Prime Demand

1. Scale and Master Planning Superiority

Palm Jebel Ali is nearly twice the size of Palm Jumeirah, offering extensive beachfront frontage and lower-density luxury clusters. This translates into:

-

Larger plot sizes

-

Expanded private beachfront access

-

Lower development saturation

-

Long-term supply control

For UHNW buyers prioritizing privacy, scale, and architectural statement, Palm Jebel Ali offers structural advantages unavailable in mature districts.

2. New-Generation Waterfront Luxury

Unlike Palm Jumeirah, where much of the inventory is resale or previously developed, Palm Jebel Ali presents next-generation waterfront estates:

-

Custom-built mega mansions

-

Contemporary architectural design

-

Smart home infrastructure

-

Sustainability-integrated construction

-

Ultra-premium interior specifications

This new-build advantage has resonated strongly with international family offices and global wealth investors seeking turnkey modern luxury.

3. Strong Off-Plan Capital Deployment

A significant proportion of Palm Jebel Ali’s AED 12.4 billion sales volume has been driven by off-plan commitments. Investors are strategically positioning capital during early development cycles to maximize appreciation.

This forward-looking capital allocation approach reflects:

-

Confidence in long-term infrastructure delivery

-

Anticipated price escalation

-

Limited ultra-prime supply pipeline

-

Institutional-grade development backing

The absorption rate indicates robust investor conviction.

Palm Jumeirah: From Pioneer to Mature Market

Palm Jumeirah remains one of Dubai’s most recognizable luxury addresses. However, its maturity presents structural constraints:

-

Limited new plot releases

-

High density in certain fronds

-

Plateauing resale pricing growth

-

Fewer large-scale new waterfront villas

As a result, capital that once concentrated exclusively in Palm Jumeirah is now diversifying toward Palm Jebel Ali, where inventory scarcity and design innovation provide stronger growth upside.

This transition is not a decline for Palm Jumeirah but a redistribution of ultra-prime capital toward expansion zones.

Investment Implications for Ultra-High-Net-Worth Buyers

Palm Jebel Ali’s 21% dominance in ultra-luxury transactions above AED 20 million signals clear investment positioning opportunities.

Capital Appreciation Potential

Early-stage master developments historically outperform mature luxury districts in price acceleration cycles. Given:

-

Infrastructure rollout

-

Beachfront scarcity

-

Institutional demand

-

International capital migration

Palm Jebel Ali is positioned for sustained upward valuation pressure.

Portfolio Diversification Strategy

Global investors allocating capital into Dubai real estate are increasingly diversifying across:

-

Branded residences

-

Custom mega-mansions

-

Waterfront plots

-

Trophy estates

Palm Jebel Ali provides diversified product typologies within the ultra-prime bracket, reinforcing its attractiveness for portfolio hedging.

Liquidity Depth and Transaction Volume

517 ultra-luxury homes transacted represents substantial liquidity in the AED 20M+ bracket. High transaction frequency enhances:

-

Price discovery transparency

-

Exit optionality

-

Secondary market activity

This level of deal velocity strengthens Palm Jebel Ali’s credibility as a sustainable luxury micro-market rather than a speculative bubble.

Dubai’s Position in the Global Ultra-Luxury Property Landscape

Dubai continues to compete aggressively with global luxury markets such as:

-

London

-

New York

-

Monaco

-

Singapore

-

Hong Kong

However, Dubai’s comparative advantages include:

-

Zero property tax

-

No capital gains tax

-

Long-term residency pathways

-

High rental yields

-

Political and economic stability

Palm Jebel Ali’s rise strengthens Dubai’s positioning as a premier global wealth hub. The AED 12.4 billion sales performance in a single location underscores the emirate’s ability to attract sustained ultra-prime capital.

Market Outlook: Sustained Ultra-Prime Expansion

Forward indicators suggest continued strength in Palm Jebel Ali’s ultra-luxury market segment:

-

Infrastructure expansion timelines progressing

-

Continued international wealth inflows

-

Strong absorption of new launches

-

Limited comparable waterfront mega-developments

As global capital reallocates toward tax-efficient and politically stable jurisdictions, Dubai remains a preferred destination. Within Dubai, Palm Jebel Ali is now the flagship growth corridor.

Transaction Breakdown and Pricing Dynamics

The average transaction size within the AED 20M+ category reflects substantial buyer confidence. Ultra-luxury villas and bespoke waterfront estates dominate the pricing curve, with several transactions exceeding benchmark thresholds.

Pricing dynamics indicate:

-

Progressive upward repricing

-

Competitive bidding for prime plots

-

Early-stage premium locking

-

Strong developer pricing power

These indicators reinforce Palm Jebel Ali’s transition from emerging district to market leader.

Strategic Conclusion: Palm Jebel Ali Redefines Dubai’s Luxury Hierarchy

The numbers are definitive:

-

21% of all ultra-luxury transactions above AED 20 million

-

517 homes sold

-

AED 12.4 billion in sales value

-

Highest-performing location in Dubai

Palm Jebel Ali has formally overtaken Palm Jumeirah as Dubai’s top ultra-luxury property market.

This milestone represents more than a ranking shift. It signals a structural reordering of Dubai’s ultra-prime real estate hierarchy. Capital has migrated toward scale, exclusivity, architectural innovation, and future growth corridors.

For investors, developers, and high-net-worth buyers evaluating Dubai’s luxury ecosystem, Palm Jebel Ali stands as the new apex of ultra-luxury residential performance.