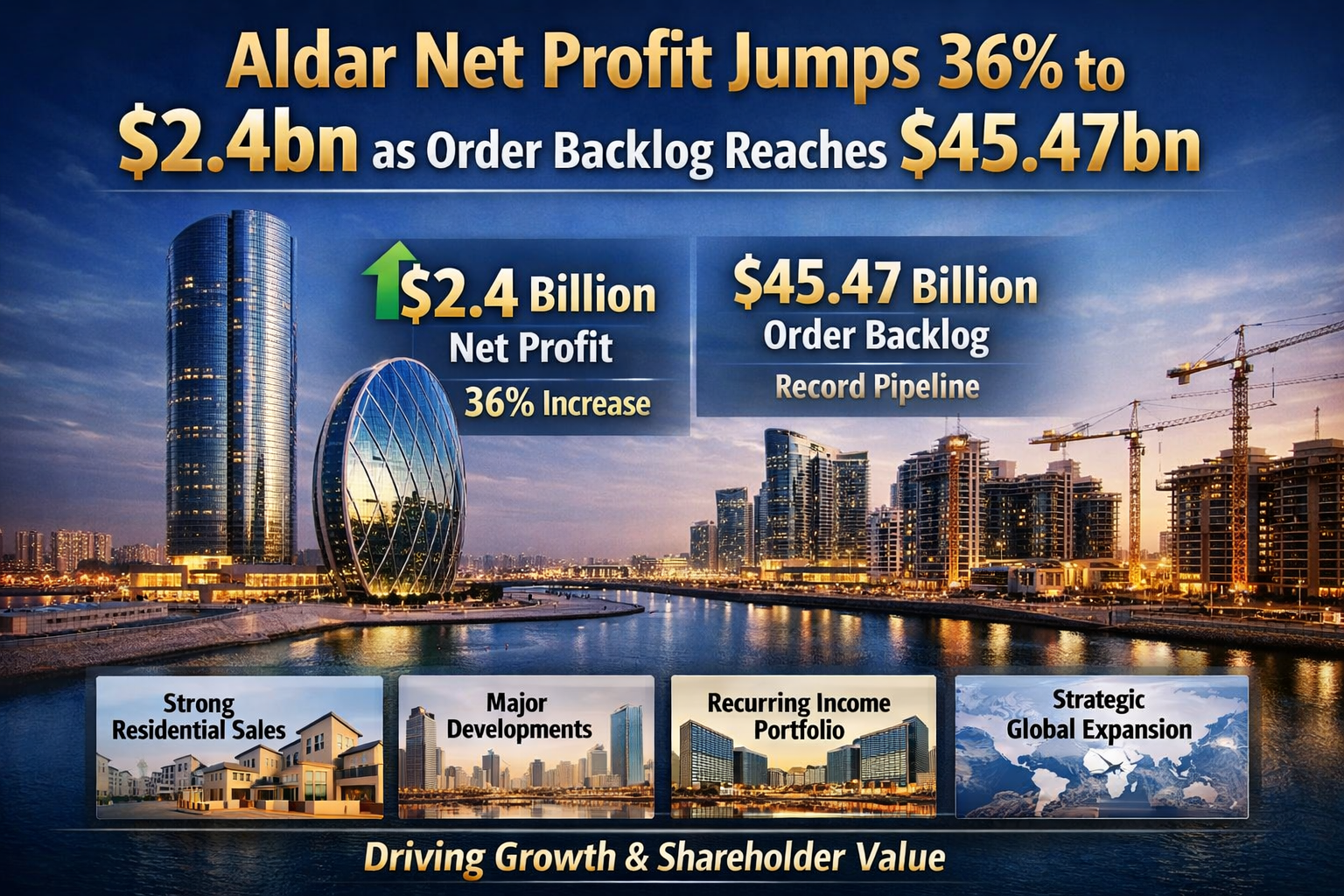

Aldar Properties has delivered a landmark financial performance, reporting a 36% surge in net profit to $2.4 billion, while its order backlog climbed to an impressive $45.47 billion. This performance underscores the company’s strengthened operational capacity, diversified asset base, and strategic expansion across high-growth real estate segments in the UAE and beyond.

The sharp increase in profitability reflects disciplined capital allocation, accelerated project delivery cycles, resilient demand in the UAE property market, and sustained investor confidence. The backlog figure—representing contracted but not yet recognized revenue—provides long-term revenue visibility and reinforces Aldar’s market leadership in integrated real estate development, investment properties, and asset management.

Net Profit Growth: Strategic Execution Driving 36% Expansion

The reported $2.4 billion net profit marks a pivotal milestone in Aldar’s financial trajectory. This 36% year-on-year increase demonstrates:

-

Higher development sales across residential and mixed-use projects

-

Strong recurring income from investment properties

-

Enhanced operational efficiencies

-

Strategic land acquisitions and portfolio expansion

Aldar’s vertically integrated model has enabled it to optimize margins across the development lifecycle—from land acquisition and planning to construction and final delivery. The growth in earnings is not merely transactional; it reflects structural strength in both development and recurring revenue streams.

Order Backlog Reaches $45.47bn: Revenue Visibility at Historic High

Aldar’s $45.47 billion order backlog is a defining indicator of future earnings potential. This backlog represents secured contracts across residential, commercial, retail, hospitality, and infrastructure projects.

Key Drivers Behind Backlog Growth

-

Strong off-plan sales in premium residential communities

-

Increased demand from international investors

-

Strategic partnerships and joint ventures

-

Expansion into new asset classes including logistics and education

The backlog ensures multi-year revenue continuity and enhances financial predictability, positioning Aldar for sustained earnings expansion over the medium to long term.

Residential Sales Surge Across Abu Dhabi and Dubai

The company’s residential portfolio continues to outperform, driven by premium developments in prime UAE locations.

Abu Dhabi Market Momentum

In Abu Dhabi, Aldar’s flagship communities have witnessed accelerated sales velocity, supported by:

-

Competitive pricing structures

-

Flexible payment plans

-

High-end lifestyle amenities

-

Infrastructure upgrades

Projects within Yas Island, Saadiyat Island, and other master-planned destinations continue attracting both end-users and institutional buyers.

Expansion into Dubai’s Prime Districts

Aldar’s strategic entry and expansion into Dubai have further strengthened revenue streams. Developments in high-demand corridors have benefited from robust investor appetite, capital appreciation prospects, and rental yield performance.

Recurring Income Portfolio Strengthens Stability

Beyond development sales, Aldar’s recurring income portfolio remains a cornerstone of financial resilience. The company maintains a diversified mix of:

-

Retail assets

-

Commercial office towers

-

Hospitality properties

-

Logistics and warehousing facilities

-

Educational institutions

This recurring income platform provides stable cash flow generation, reducing exposure to cyclical fluctuations in development sales.

Capital Deployment and Strategic Acquisitions

Aldar’s disciplined capital deployment strategy has significantly enhanced asset value and earnings quality. The company continues to invest in:

-

Prime land banks

-

High-yield commercial properties

-

Institutional-grade logistics facilities

-

Mixed-use urban communities

Strategic acquisitions have strengthened Aldar’s geographic footprint while increasing portfolio diversification. This calculated expansion approach has amplified shareholder returns and reinforced long-term growth prospects.

Macro-Economic Tailwinds Supporting Growth

The UAE’s macroeconomic environment has played a supportive role in Aldar’s financial success.

Key Economic Catalysts

-

Strong GDP growth

-

Population expansion

-

Pro-investment government policies

-

Infrastructure modernization

-

Increased foreign direct investment

The resilience of Abu Dhabi’s economy, combined with sustained global investor confidence, has created an environment conducive to real estate expansion.

Balance Sheet Strength and Liquidity Position

Aldar’s strong financial performance is complemented by a robust balance sheet structure. The company maintains:

-

Healthy liquidity reserves

-

Investment-grade credit ratings

-

Optimized debt-to-equity ratios

-

Efficient working capital management

This financial discipline enhances flexibility for future acquisitions, development launches, and capital-intensive projects.

Sustainable Development and ESG Integration

Environmental, Social, and Governance (ESG) principles remain embedded within Aldar’s strategic framework. The company continues to prioritize:

-

Green building certifications

-

Energy-efficient design standards

-

Smart city integration

-

Sustainable construction materials

-

Carbon reduction initiatives

By aligning development objectives with sustainability goals, Aldar enhances asset longevity and appeals to environmentally conscious investors.

International Expansion Strategy

Aldar’s growth narrative extends beyond the UAE. Strategic international investments and partnerships are broadening its footprint across emerging and established markets.

The focus remains on:

-

High-growth urban corridors

-

Institutional partnerships

-

Asset-light investment models

-

Diversified revenue channels

This measured international approach strengthens global brand recognition while mitigating geographic concentration risk.

Shareholder Value Creation

The combination of record net profit and expanding backlog reinforces Aldar’s commitment to shareholder value. The company continues to prioritize:

-

Dividend sustainability

-

Earnings per share growth

-

Return on equity optimization

-

Long-term capital appreciation

The 36% profit increase directly translates into enhanced financial returns for investors, solidifying Aldar’s reputation as a high-performance real estate enterprise.

Future Outlook: Sustained Earnings Momentum

With a $45.47 billion order backlog and diversified revenue streams, Aldar is positioned for continued growth. The pipeline of residential launches, commercial developments, and recurring income expansion supports a multi-year earnings trajectory.

Key growth pillars include:

-

Launch of premium waterfront communities

-

Expansion of logistics and warehousing assets

-

Growth in education and healthcare real estate

-

Strategic land acquisitions

-

Technology-driven property management

The operational discipline demonstrated in achieving $2.4 billion net profit indicates sustained momentum rather than short-term acceleration.

Why Aldar’s Performance Sets a Benchmark in the Region

Aldar’s 36% profit jump is not an isolated financial achievement—it represents structural market leadership in the Middle East real estate sector.

Competitive Advantages

-

Integrated development platform

-

Strong government alignment

-

Premium asset portfolio

-

Long-term revenue visibility

-

Capital efficiency

These attributes collectively position Aldar as a dominant force within the regional property landscape.

Conclusion: A Defining Year of Financial Strength

The reported $2.4 billion net profit and $45.47 billion order backlog mark a defining chapter in Aldar’s growth story. The company’s operational efficiency, strategic foresight, and diversified portfolio have produced measurable financial results.

As demand for premium real estate in the UAE continues to expand, Aldar’s integrated model, recurring income strength, and capital discipline ensure that the company remains firmly positioned at the forefront of the region’s property sector.

The financial metrics demonstrate sustained profitability, forward revenue certainty, and strategic scalability—reinforcing Aldar’s status as one of the most powerful and resilient real estate developers in the Middle East.