Dubai’s luxury real estate market is undergoing a decisive transformation. High-net-worth individuals, family offices, and institutional-grade investors are increasingly prioritizing proven developers, delivery certainty, and asset longevity over short-term speculative gains. This shift reflects a market that has matured into a capital-preservation and wealth-compounding ecosystem, where long-term value creation now outweighs opportunistic flipping.

Buyers are focusing on projects with verified track records, strong post-handover performance, and consistent rental absorption, ensuring that capital is deployed into assets that sustain growth across multiple cycles. This behavioral change is strengthening market fundamentals and reinforcing Dubai’s position as a global safe-haven for premium property investment.

Why Proven Developers Now Dominate Buyer Preference

Track Record as a Core Investment Filter

Luxury buyers are increasingly filtering opportunities based on historical delivery performance, construction quality, and post-handover asset management standards. Developers with consistent completion timelines, transparent escrow practices, and stable design philosophies command stronger demand and pricing power.

Projects by reputable master developers benefit from:

-

Lower construction risk

-

Stronger resale liquidity

-

Higher tenant retention

-

Sustained community upkeep

These attributes directly impact long-term asset performance, which aligns with buyers seeking capital stability rather than speculative turnover.

Brand Equity Drives Premium Valuations

In Dubai’s luxury segment, developer brand has become a pricing determinant. Buyers are willing to pay valuation premiums for projects associated with established names because brand equity reduces uncertainty across every stage of the ownership lifecycle, from delivery to resale.

Strong brands also attract:

-

Higher-quality tenants

-

Global investor attention

-

Cross-border financing eligibility

This reinforces price resilience during market corrections, making brand-backed projects strategic long-term holdings.

From Transactional Trading to Portfolio Allocation

Luxury Real Estate as a Strategic Asset Class

Affluent buyers now treat Dubai property as part of a diversified international portfolio, comparable to equities, private credit, and commercial real estate holdings. This institutional mindset is reshaping purchase behavior, shifting demand toward assets that offer:

-

Predictable yield

-

Capital appreciation consistency

-

Exit liquidity at scale

Short-term flipping exposes investors to timing risk and market sentiment volatility, while long-hold strategies benefit from Dubai’s sustained population growth, infrastructure investment, and international business inflows.

End-User and Lifestyle Buyers Reinforce Stability

An expanding segment of luxury transactions is driven by end-users relocating for business, family, and lifestyle integration. These buyers prioritize:

-

Community planning

-

School access

-

Healthcare proximity

-

Retail and hospitality integration

As occupancy periods extend, resale cycles lengthen, reducing speculative churn and enhancing market depth.

Location Strategy: Prime Districts Outperform Peripheral Growth

Established Luxury Zones Lead Capital Inflows

Long-term capital is gravitating toward districts with proven demand durability and infrastructure maturity, including:

-

Downtown Dubai

-

Palm Jumeirah

-

Dubai Marina

-

City Walk

-

Jumeirah Bay Island

These areas offer limited new supply, high international recognition, and stable rental demand from executive tenants and ultra-high-net-worth residents.

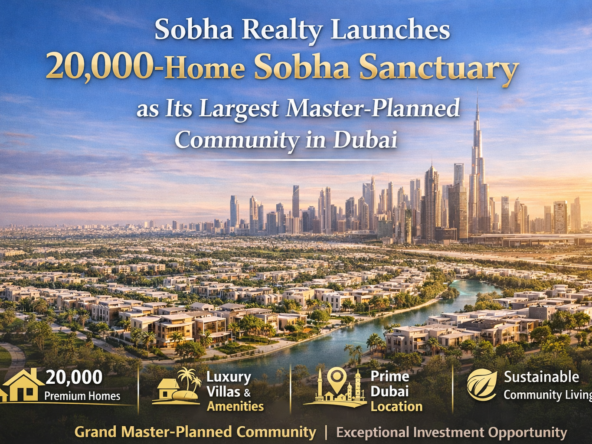

Master-Planned Communities Deliver Lifecycle Value

Buyers are favoring master-planned developments with integrated lifestyle ecosystems, where property values benefit from:

-

Ongoing retail expansion

-

Hospitality branding

-

Waterfront or park access

-

Transit connectivity

Such communities protect long-term appreciation by continuously enhancing resident experience, rather than relying solely on unit-level features.

Design, Sustainability, and Post-Handover Services Matter More Than Ever

Premium Buyers Demand Operational Excellence

Luxury buyers are increasingly evaluating what happens after handover, not just architectural renderings. Developments with strong property management frameworks, concierge services, and maintenance response systems command higher occupancy and resale values.

Operational performance influences:

-

Tenant satisfaction

-

Short-term rental eligibility

-

Corporate leasing contracts

These factors directly affect net yield and long-term asset reputation.

Sustainability Enhances Investment Appeal

Environmental performance now plays a role in luxury property valuation. Buyers are assessing:

-

Energy-efficient systems

-

Smart home integration

-

Sustainable materials

-

Community green spaces

Sustainability improves operating cost efficiency while aligning assets with evolving international ESG investment criteria.

International Capital Flows Favor Long-Term Security

Wealth Migration Fuels Enduring Demand

Dubai continues to attract global entrepreneurs, senior executives, and family offices seeking regulatory stability and tax efficiency. These demographics prefer secure, well-managed developments where capital can remain deployed for extended periods without operational burden.

Residency-linked property investment programs further support long-term ownership, reinforcing stable absorption across premium developments.

Currency Hedging and Capital Preservation Motives

For many international buyers, Dubai property serves as a hedge against:

-

Currency depreciation

-

Political uncertainty

-

Regulatory volatility in home markets

This drives conservative acquisition strategies focused on asset durability rather than transactional profit cycles.

Financing and Institutional Participation Elevate Market Maturity

Private Banking and Structured Financing Expand

High-value mortgage products, developer-backed payment plans, and private banking partnerships are enabling buyers to optimize capital deployment while retaining liquidity. These structures support:

-

Portfolio scaling

-

Risk diversification

-

Long-term holding capacity

As financing sophistication grows, speculative flipping becomes less attractive compared to leveraged yield optimization.

Institutional Buyers Raise Market Standards

The entry of regional and international investment funds increases demand for:

-

Transparent governance

-

Professional asset management

-

Reliable developer compliance

Institutional participation raises quality thresholds across the market, benefiting end-users and long-term private investors alike.

Resale Market Signals Confirm Long-Hold Dominance

Reduced Short-Term Turnover in Prime Projects

Top-tier developments now experience lower transactional churn, indicating owners are holding assets through market cycles. Reduced inventory improves pricing stability and strengthens negotiation power for sellers.

Secondary market activity is increasingly driven by:

-

Lifestyle upgrades

-

Portfolio rebalancing

-

Geographic relocation

Rather than speculative arbitrage.

Price Growth Reflects Organic Demand, Not Speculation

Sustained appreciation in luxury zones is now supported by occupier-driven demand and wealth inflows, not artificial trading velocity. This results in healthier, more predictable valuation curves over time.

Developer Selection as a Risk Management Strategy

Construction Quality Protects Asset Lifespan

Superior build standards reduce long-term capital expenditure, preserving net returns. Buyers are assessing:

-

Material durability

-

Mechanical system reliability

-

Structural engineering certifications

These technical elements directly influence asset performance over decades, not just during initial ownership.

After-Sales Service Builds Long-Term Confidence

Reliable warranty programs, responsive maintenance teams, and transparent service charge structures enhance owner retention and secondary buyer confidence, sustaining liquidity even in slower market phases.

Market Outlook: Long-Term Capital Continues to Lead

Dubai’s luxury real estate sector is evolving into a global capital preservation platform, attracting disciplined investors who prioritize reliability, lifestyle integration, and governance standards. As regulatory frameworks strengthen and urban development expands, the dominance of long-term capital is expected to deepen.

Key drivers sustaining this trajectory include:

-

International wealth migration

-

Corporate relocation trends

-

Infrastructure mega-projects

-

Hospitality-branded residential expansion

These forces align with buyer preferences for stable, income-generating, and prestige-backed assets.

Conclusion: Stability, Brand Trust, and Enduring Value Define the New Luxury Buyer

The current market cycle confirms that Dubai’s luxury buyers are no longer motivated by rapid transaction gains. Instead, they are deploying capital into proven developments, prime locations, and operationally robust communities that deliver sustained financial and lifestyle returns.

This evolution strengthens market resilience, elevates construction standards, and positions Dubai as a long-term global capital hub for premium residential investment. In this environment, developer credibility, project execution, and asset longevity are not optional advantages—they are the primary drivers of buyer confidence and market leadership.